Financials

Financial Statements And Related Announcement - Full Yearly Results 2025

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

-

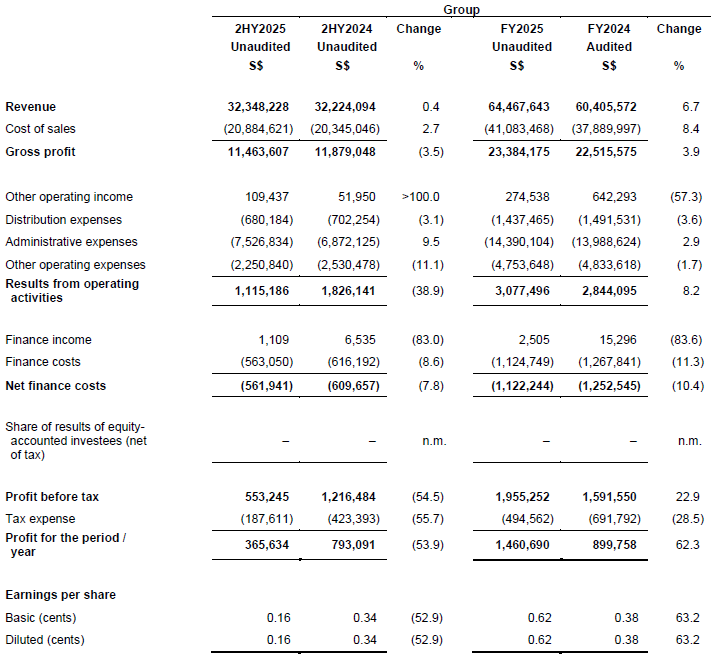

CONDENSED INTERIM CONSOLIDATED STATEMENT OF PROFIT OR LOSS

Notes:

(1) 2HY2025 : 6 months ended 30 June 2025

(2) 2HY2024 : 6 months ended 30 June 2024

(3) FY2025 : 12 months ended 30 June 2025

(4) FY2024 : 12 months ended 30 June 2024

(5) n.m.: not meaningful. -

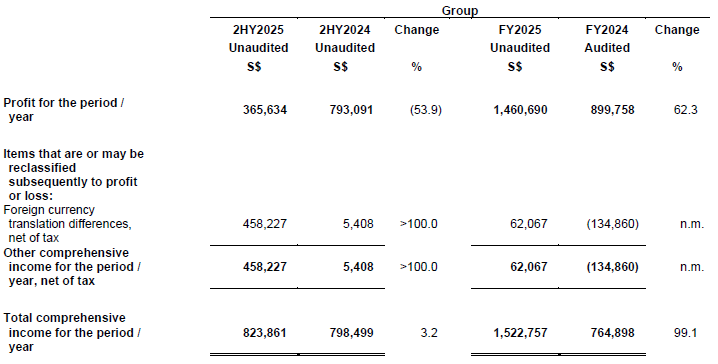

CONDENSED INTERIM CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

-

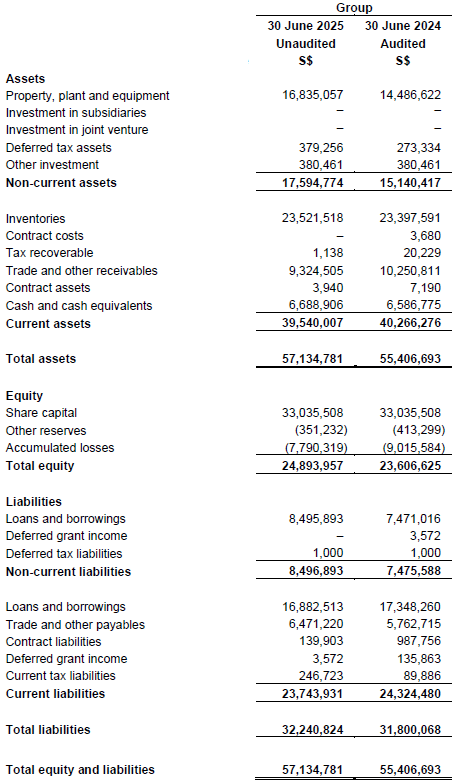

CONDENSED INTERIM STATEMENTS OF FINANCIAL POSITION

-

FINANCIAL PERFORMANCE REVIEW

Comparing 2HY2025 to 2HY2024

Revenue

Revenue increased by S$0.1 million or 0.4% to S$32.3 million for the financial period from 1 January 2025 to 30 June 2025 ("2HY2025") from S$32.2 million for the financial period from 1 January 2024 to 30 June 2024 ("2HY2024").

- Marine & Offshore Segment revenue increased by 1.8% or S$0.5 million in 2HY2025 as compared to 2HY2024 due to the increase in revenue contribution from the mooring and rigging business. The increase was supported by orders received from newly-built vessels, which contributed to stronger sales during the period.

- Others Segment revenue fell by 21.7% or S$0.4 million in 2HY2025 as compared to 2HY2024. The decrease was mainly due to the lower contributions from water and environmental treatment business by S$0.3 million and property consultancy business by S$0.1 million. This decline also led to reduction in the cost of sales for this segment.

Gross profit

The Group's gross profit of S$11.5 million in 2HY2025 was a decrease of S$0.4 million or 3.5% compared to 2HY2024. The Group's gross profit margin decreased to 35.4% in 2HY2025 as compared to 36.9% in 2HY2024.

- Marine & Offshore Segment contributed gross profit of S$10.7 million to the Group in 2HY2025 as compared to S$11.0 million in 2HY2024. Despite the increase in revenue, the gross profit margin decreased to 34.7% in 2HY2025 from 36.4% in 2HY2024, mainly due to lower margins in the mooring and rigging business to remain competitive under current market conditions.

- Others Segment contributed gross profit of S$0.8 million to the Group in 2HY2025, comprising S$0.5 million from the water treatment business and S$0.3 million from the property consultancy business.

Other operating income

Other operating income increased by S$57,000 to S$109,000 in 2HY2025 from S$52,000 in 2HY2024 mainly due to gain on disposal of property, plant and equipment.

Distribution expenses

Distribution expenses decreased by S$22,000 or 3.1% to S$680,000 in 2HY2025 from S$702,000 in 2HY2024 due to lower freight costs as a result of easing of supply chain disruptions.

Administrative expenses

Administrative expenses increased by S$0.6 million or 9.5% to S$7.5 million in 2HY2025 from S$6.9 million in 2HY2024, mainly due to higher manpower costs, driven by necessary salary adjustments to enhance the Group's market competitiveness.

Other operating expenses

Other operating expenses decreased by S$0.3 million or 11.1% to S$2.2 million in 2HY2025 from S$2.5 million in 2HY2024. The decrease was mainly due to (i) decrease in depreciation of property, plant and equipment by S$0.2 million and (ii) decrease in fair value loss on derivatives by S$0.1 million.

Finance income

Finance income, comprising mainly interest income from bank deposits, remained insignificant for 2HY2025.

Finance costs

Finance costs decreased by S$53,000 or 8.6% in 2HY2025, mainly due to lower interest rates.

Income tax expense

In 2HY2025, the Group incurred lower tax expense of S$0.2 million as compared to S$0.4 million in 2HY2024 due to lower profit for the financial period.

Profit for the period

Combining the profit before tax of S$1.3 million for the Marine & Offshore Segment, loss before tax of S$0.3 million from the Others Segment and the unallocated head office expenses of S$0.4 million, the Group's profit before tax was S$0.6 million in 2HY2025 as compared to a profit before tax of S$1.2 million in 2HY2024. Overall, the Group reported profit after taxation of S$0.4 million for 2HY2025 (2HY2024: S$0.8 million).

Comparing FY2025 to FY2024

Revenue

Revenue increased by S$4.1 million or 6.7% to S$64.5 million for FY2025 from S$60.4 million for FY2024.

- Marine & Offshore Segment revenue increased by S$3.9 million or 6.9% in FY2025 as compared to FY2024. The increase was mainly attributable to increased revenue contribution from the mooring and rigging business. The increase was supported by orders received from newly-built vessels, which contributed to stronger sales during the period.

- Others Segment revenue increased by S$0.2 million or 3.4% in FY2025 as compared to FY2024. The increase was mainly due to revenue contribution from the water and environmental treatment business. This increase also resulted in a corresponding rise in the segment's cost of sales.

Gross profit

The Group's gross profit of S$23.4 million in FY2025 increased by S$0.9 million or 3.9% from S$22.5 million in FY2024. The Group's gross profit margin decreased to 36.1% in FY2025 as compared to 37.3% in FY2024.

- Marine & Offshore Segment contributed gross profit of S$21.4 million to the Group in FY2025 as compared to S$20.9 million in FY2024. Despite the increase in revenue, the gross profit margin decreased to 35.2% in FY2025 from 37.1% in FY2024, mainly due to lower margins in the mooring and rigging business to remain competitive under current market conditions.

- Others Segment contributed gross profit of S$2.0 million to the Group in FY2025, comprising S$1.2 million from the water and treatment business and S$0.8 million from the property consultancy business.

Other operating income

Other operating income decreased by S$0.3 million or 57.3% to S$0.3 million in FY2025 from S$0.6 million in FY2024. The decrease was mainly due to the absence of gain on disposal of asset held for sale.

Distribution expenses

Distribution expenses decreased by S$0.1 million or 3.6% to S$1.4 million in FY2025 from S$1.5 million in FY2024 due to lower freight costs as a result of easing of supply chain disruptions.

Administrative expenses

Administrative expenses increased by S$0.4 million or 2.9% to S$14.4 million in FY2025 from S$14.0 million in FY2024, mainly due to higher manpower costs resulting from necessary salary adjustments to remain competitive in attracting talents from the job market.

Other operating expenses

Other operating expenses decreased by S$0.1 million or 1.7% to S$4.7 million in FY2025 from S$4.8 million in FY2024. The decrease was mainly due to decrease in depreciation of property, plant and equipment.

Finance income

Finance income, comprising mainly interest income from bank deposits, remained insignificant for FY2024.

Finance costs

Finance costs decreased by S$0.2 million or 11.3% to S$1.1 million in FY2025 from S$1.3 million in FY2024 due to lower interest rates in FY2025 compared to FY2024.

Income tax expense

In FY2025, the Group incurred an income tax expense of S$0.5 million as compared to S$0.7 million in FY2024. This was largely attributed to reduced contributions from TEHO Europe B.V., where the corporate tax rate in the Netherlands is higher than in Singapore.

Profit for the year

Combining the profit before tax of S$2.7 million for the Marine & Offshore Segment, loss before tax of S$0.2 million for the Others Segment and the unallocated head office expenses of S$0.5 million, the Group's profit before tax was S$2.0 million in FY2025 as compared to a profit before tax of S$1.6 million in FY2024. After accounting for income tax expense of S$0.5 million in FY2025, the Group's profit for FY2025 was S$1.5 million as compared to a profit of S$0.9 million in FY2024.

-

FINANCIAL POSITION REVIEW

Non-current assets

Non-current assets increased by S$2.5 million to S$17.6 million as at 30 June 2025 from S$15.1 million as at 30 June 2024. The increase was mainly due to the following:

- Property, plant and equipment increased by S$2.4 million, due to the acquisition of plant and equipment of S$4.7 million. This is partially offset by depreciation of property, plant and equipment of S$1.9 million and disposal of plant and equipment of S$0.4 million; and

- Deferred tax assets increased by S$0.1 million.

Current assets

Current assets decreased by S$0.8 million from S$40.3 million as at 30 June 2024 to S$39.5 million as at 30 June 2025. The decrease was mainly due to the decrease in trade and other receivables of S$1.0 million, reflecting tighter credit control.

The decrease stated above was partially offset by:

- Inventory increased by S$0.1 million from S$23.4 million as at 30 June 2024 to S$23.5 million as at 30 June 2025. This increase was attributed to proactive measures taken in anticipation of extended lead times for the supply of inventory within the Marine & Offshore Segment.

- Cash and cash equivalents increased by S$0.1 million from S$6.6 million as at 30 June 2024 to S$6.7 million as at 30 June 2025. Please refer to the "Cash Flows Review" section below for details.

Non-current liabilities

Non-current liabilities increased by S$1.0 million to S$8.5 million as at 30 June 2025 from S$7.5 million as at 30 June 2024. The increase was attributed to the loan financing obtained to fund the acquisition of warehousing facility in the Republic of Korea by TEHO Ropes Korea Co., Ltd., a wholly-owned subsidiary of the Company. Please refer to the Company's SGXNet announcement dated 2 October 2024 for further details.

Current liabilities

Current liabilities decreased by S$0.6 million to S$23.7 million as at 30 June 2025 from S$24.3 million as at 30 June 2024. The decrease was mainly due to the following:

- Current portion of loans and borrowings decreased by S$0.4 million, as a result of repayment of term loans and lease liabilities; and

- Contract liabilities decreased by S$0.9 million attributable to lesser advances received from customers due to completion of several projects before the year end.

The decrease stated above was partially offset by an increase in trade and other payables of S$0.7 million, mainly due to extended payment terms with suppliers.

Shareholders' equity

As a result of the above, total equity of the Group increased by S$1.3 million to S$24.9 million as at 30 June 2025 from S$23.6 million as at 30 June 2024.

-

CASH FLOWS REVIEW

The Group's net cash flows generated from operating activities was S$5.0 million in FY2025 compared to S$4.0 million in FY2024. The increase was mainly due to higher profit before tax, reductions in trade and other receivables, and improved cash flow management through extended payment terms with suppliers.

Net cash flows used in investing activities amounted to S$2.3 million in FY2025, mainly due to the capital expenditure on the acquisition of property, plant and equipment.

Net cash flows used in financing activities amounted to S$2.7 million in FY2025 was mainly due to dividend payment of S$0.2 million, interest payment of S$1.1 million, repayment of loans and borrowings of S$19.1 million, and payment of lease liabilities of S$0.9 million; partially offset by proceeds from the drawdown of loans and borrowings of S$18.6 million.

As at 30 June 2025, the Group has cash and cash equivalents of S$6.7 million as compared to S$6.6 million as at 30 June 2024.

-

COMMENTARY

Amid recent global economic developments, including continued trade tensions, new trade tariffs and signs of slowing growth in major economies, the Group maintains a cautious outlook for the next twelve months. Rising costs, persistent inflation, and uncertainties in global trade and supply chains continue to pose challenges.

Despite our improved results in FY2025 compared to FY2024, we remain prudent and will continue to focus on cost control and operational efficiencies to ensure the sustainability of our businesses.